All Categories

Featured

Table of Contents

It's essential to bear in mind that SEC guidelines for recognized capitalists are made to secure capitalists. Without oversight from economic regulators, the SEC just can not assess the danger and reward of these investments, so they can't offer details to educate the typical financier.

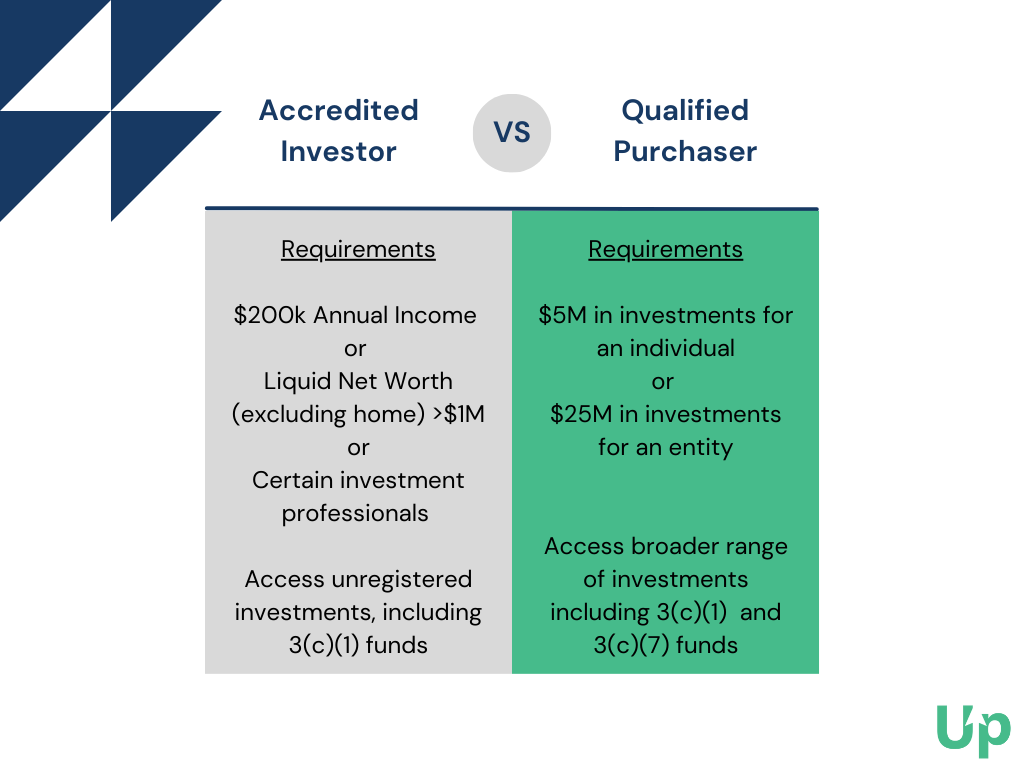

The concept is that investors that make enough income or have adequate wealth are able to take in the threat much better than financiers with reduced earnings or much less wealth. accredited investor property investment deals. As an accredited capitalist, you are expected to finish your very own due diligence prior to including any kind of asset to your investment profile. As long as you fulfill among the following four needs, you certify as an approved capitalist: You have actually earned $200,000 or even more in gross earnings as a specific, every year, for the previous 2 years

You and your partner have actually had a combined gross earnings of $300,000 or more, each year, for the previous two years. And you expect this degree of income to proceed.

Professional Accredited Investor Investment Opportunities

Or all equity owners in the service certify as certified capitalists. Being an accredited capitalist opens up doors to investment opportunities that you can not access or else.

Becoming a certified investor is simply an issue of verifying that you fulfill the SEC's demands. To confirm your earnings, you can offer documentation like: Revenue tax returns for the past two years, Pay stubs for the past 2 years, or W2s for the past 2 years. To confirm your web worth, you can supply your account declarations for all your possessions and obligations, consisting of: Cost savings and checking accounts, Financial investment accounts, Outstanding finances, And genuine estate holdings.

Five-Star Accredited Investor Funding Opportunities

You can have your attorney or CPA draft a confirmation letter, validating that they have actually evaluated your financials and that you satisfy the requirements for an approved investor. It might be a lot more economical to use a service particularly developed to confirm certified investor standings, such as EarlyIQ or .

For example, if you register with the realty investment firm, Gatsby Investment, your recognized investor application will be processed with VerifyInvestor.com at no charge to you. The terms angel investors, advanced financiers, and recognized investors are frequently made use of mutually, however there are subtle differences. Angel investors supply venture capital for startups and local business for ownership equity in the organization.

Generally, any person who is approved is thought to be an advanced financier. People and service entities that maintain high revenues or considerable riches are assumed to have affordable expertise of money, certifying as advanced. Yes, global investors can end up being accredited by American monetary criteria. The income/net worth requirements remain the very same for foreign financiers.

Below are the ideal financial investment opportunities for certified capitalists in genuine estate. is when investors pool their funds to buy or renovate a property, after that share in the proceeds. Crowdfunding has actually turned into one of the most preferred methods of investing in actual estate online because the JOBS Act of 2012 permitted crowdfunding platforms to provide shares of real estate tasks to the public.

Optimized Accredited Investor Growth Opportunities for Accredited Investment Results

Some crowdfunded real estate financial investments do not need accreditation, but the tasks with the best potential incentives are commonly scheduled for certified capitalists. The distinction between tasks that accept non-accredited financiers and those that just accept recognized financiers normally comes down to the minimal financial investment quantity. The SEC currently restricts non-accredited investors, that make less than $107,000 per year) to $2,200 (or 5% of your yearly earnings or net worth, whichever is less, if that quantity is more than $2,200) of financial investment funding annually.

It is really similar to real estate crowdfunding; the process is essentially the very same, and it comes with all the exact same advantages as crowdfunding. Actual estate syndication supplies a steady LLC or Statutory Trust fund ownership design, with all financiers offering as members of the entity that possesses the underlying actual estate, and an organization who facilitates the task.

a firm that buys income-generating actual estate and shares the rental revenue from the homes with financiers in the type of returns. REITs can be openly traded, in which situation they are regulated and readily available to non-accredited capitalists. Or they can be personal, in which instance you would need to be accredited to invest.

Accredited Investor Investment Opportunities

It is necessary to keep in mind that REITs generally include a number of fees. Administration fees for an exclusive REIT can be 1-2% of your total equity annually Procurement charges for brand-new acquisitions can come to 1-2% of the purchase rate. Administrative fees can total (accredited investor real estate deals).1 -.2% annually. And you might have performance-based fees of 20-30% of the private fund's profits.

However, while REITs concentrate on tenant-occupied properties with secure rental revenue, private equity real estate firms concentrate on property advancement. These firms often establish a plot of raw land into an income-generating residential property like an apartment complex or retail purchasing. As with exclusive REITs, investors secretive equity endeavors typically need to be approved.

The SEC's definition of accredited capitalists is designed to determine people and entities considered financially advanced and qualified of evaluating and joining certain kinds of exclusive financial investments that might not be readily available to the public. Significance of Accredited Financier Status: Conclusion: Finally, being a recognized capitalist lugs considerable relevance in the globe of finance and financial investments.

Sought-After Accredited Investor Wealth-building Opportunities

By fulfilling the criteria for accredited financier status, people demonstrate their economic refinement and access to a globe of financial investment opportunities that have the prospective to generate significant returns and add to long-lasting economic success (real estate investments for accredited investors). Whether it's spending in start-ups, real estate endeavors, private equity funds, or other alternative assets, accredited investors have the advantage of discovering a diverse selection of financial investment options and building wide range by themselves terms

Certified financiers include high-net-worth people, banks, insurance provider, brokers, and trust funds. Approved financiers are defined by the SEC as certified to invest in complicated or sophisticated kinds of safety and securities that are not closely controlled. Particular requirements have to be fulfilled, such as having a typical yearly revenue over $200,000 ($300,000 with a partner or cohabitant) or operating in the economic sector.

Unregistered securities are naturally riskier because they lack the normal disclosure needs that come with SEC enrollment. Investopedia/ Katie Kerpel Accredited investors have blessed access to pre-IPO companies, equity capital business, hedge funds, angel financial investments, and various offers involving complex and higher-risk financial investments and tools. A firm that is seeking to raise a round of funding might make a decision to directly come close to certified financiers.

Latest Posts

Homes With Unpaid Taxes

Certificate In Invest Lien Tax

2021 Delinquent Property Tax List