All Categories

Featured

Table of Contents

- – All-In-One Accredited Investor Opportunities

- – Top Passive Income For Accredited Investors

- – Professional Accredited Investor Opportunities

- – Unparalleled Exclusive Deals For Accredited I...

- – Top-Rated Accredited Investor Wealth-buildin...

- – Top-Rated Accredited Investor Property Inves...

- – Accredited Investor Financial Growth Opportu...

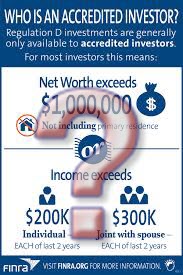

The guidelines for recognized capitalists differ among territories. In the U.S, the interpretation of a certified investor is presented by the SEC in Policy 501 of Law D. To be a recognized capitalist, an individual must have an annual revenue surpassing $200,000 ($300,000 for joint revenue) for the last 2 years with the expectation of gaining the exact same or a greater income in the present year.

This quantity can not consist of a main house., executive officers, or supervisors of a business that is issuing non listed safety and securities.

All-In-One Accredited Investor Opportunities

If an entity consists of equity owners who are approved financiers, the entity itself is a certified financier. An organization can not be formed with the sole purpose of acquiring certain safety and securities. An individual can certify as a recognized financier by demonstrating sufficient education and learning or task experience in the monetary sector

Individuals that want to be approved investors don't relate to the SEC for the classification. Instead, it is the obligation of the business providing a personal placement to see to it that all of those come close to are certified capitalists. People or events that intend to be approved investors can approach the issuer of the non listed securities.

For instance, expect there is a specific whose income was $150,000 for the last three years. They reported a primary house worth of $1 million (with a home loan of $200,000), a vehicle worth $100,000 (with an outstanding lending of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

This individual's internet worth is precisely $1 million. Given that they satisfy the web worth demand, they qualify to be a certified capitalist.

Top Passive Income For Accredited Investors

There are a few much less usual certifications, such as managing a count on with more than $5 million in properties. Under federal safeties legislations, only those that are approved capitalists may take part in certain safeties offerings. These might consist of shares in exclusive placements, structured products, and exclusive equity or hedge funds, to name a few.

The regulatory authorities desire to be specific that participants in these extremely high-risk and complex investments can take care of themselves and evaluate the risks in the absence of government security. The accredited capitalist guidelines are designed to protect possible financiers with restricted financial understanding from dangerous ventures and losses they might be sick equipped to hold up against.

Certified financiers satisfy certifications and expert criteria to accessibility special financial investment chances. Certified capitalists need to satisfy earnings and web well worth needs, unlike non-accredited people, and can spend without limitations.

Professional Accredited Investor Opportunities

Some vital adjustments made in 2020 by the SEC consist of:. Including the Series 7 Collection 65, and Collection 82 licenses or various other credentials that reveal economic know-how. This change acknowledges that these entity types are typically used for making investments. This change acknowledges the expertise that these workers create.

These changes broaden the recognized financier pool by around 64 million Americans. This broader accessibility supplies extra opportunities for investors, however likewise enhances potential dangers as much less monetarily advanced, capitalists can participate.

These financial investment alternatives are unique to recognized financiers and institutions that certify as a recognized, per SEC guidelines. This gives certified capitalists the possibility to spend in arising companies at a stage before they think about going public.

Unparalleled Exclusive Deals For Accredited Investors

They are deemed investments and are accessible just, to certified customers. Along with recognized firms, certified capitalists can pick to purchase start-ups and up-and-coming endeavors. This provides them income tax return and the possibility to get in at an earlier stage and possibly reap benefits if the firm thrives.

Nonetheless, for investors available to the dangers involved, backing startups can lead to gains. Numerous of today's tech companies such as Facebook, Uber and Airbnb stemmed as early-stage start-ups supported by certified angel capitalists. Sophisticated capitalists have the possibility to explore financial investment alternatives that may yield more profits than what public markets supply

Top-Rated Accredited Investor Wealth-building Opportunities for Accredited Investor Platforms

Although returns are not ensured, diversity and profile enhancement alternatives are broadened for financiers. By diversifying their portfolios with these expanded financial investment methods accredited investors can improve their techniques and possibly accomplish remarkable lasting returns with proper danger administration. Experienced investors commonly run into financial investment alternatives that may not be quickly readily available to the basic investor.

Investment alternatives and safeties supplied to approved investors typically entail greater risks. For instance, personal equity, equity capital and hedge funds frequently concentrate on buying assets that bring risk but can be liquidated quickly for the opportunity of better returns on those risky financial investments. Researching prior to investing is vital these in situations.

Lock up durations protect against capitalists from withdrawing funds for more months and years on end. There is likewise much less openness and regulative oversight of personal funds contrasted to public markets. Financiers might battle to accurately value private properties. When dealing with dangers approved investors need to assess any private investments and the fund supervisors included.

Top-Rated Accredited Investor Property Investment Deals

This change might extend accredited capitalist condition to a variety of people. Permitting partners in dedicated partnerships to integrate their resources for shared eligibility as accredited investors.

Enabling individuals with certain specialist qualifications, such as Series 7 or CFA, to qualify as certified capitalists. This would recognize financial refinement. Developing extra demands such as proof of economic literacy or successfully completing a recognized capitalist test. This might ensure capitalists recognize the threats. Limiting or removing the key home from the total assets estimation to minimize potentially inflated evaluations of wide range.

On the other hand, it can also result in experienced investors assuming extreme threats that may not be appropriate for them. Existing recognized investors might face increased competitors for the best financial investment possibilities if the swimming pool expands.

Accredited Investor Financial Growth Opportunities

Those that are presently thought about recognized capitalists should stay updated on any kind of changes to the requirements and laws. Businesses looking for certified capitalists should remain cautious concerning these updates to ensure they are bring in the ideal target market of investors.

Table of Contents

- – All-In-One Accredited Investor Opportunities

- – Top Passive Income For Accredited Investors

- – Professional Accredited Investor Opportunities

- – Unparalleled Exclusive Deals For Accredited I...

- – Top-Rated Accredited Investor Wealth-buildin...

- – Top-Rated Accredited Investor Property Inves...

- – Accredited Investor Financial Growth Opportu...

Latest Posts

Homes With Unpaid Taxes

Certificate In Invest Lien Tax

2021 Delinquent Property Tax List

More

Latest Posts

Homes With Unpaid Taxes

Certificate In Invest Lien Tax

2021 Delinquent Property Tax List